We have been a homeschool family since 2013 and loved it. During that time, Mia also was still doing 30-40 hours of ABA (applied behavior analysis) therapy per week. So much has changed for her in the last year and there were some areas she was still struggling in. I had tried multiple curriculums to help her with reading, but the hurdle was still too high.

After the pandemic hit and public schools had to implement distance learning, a light bulb went off. She has always been a student who would be homebound (not in a school setting) due to her immune deficiency and numerous allergies, there would be no way to keep her safe in a school building, but years ago, the technology just wasn't there to provide the support she needed.

When we built our home and moved in 2020, I had heard that families move to our area just for the schools. After things got settled with everything that was going on in the world I decided I would reluctantly call the school system and see what they had to offer for Mia. I was very open with them of my concerns, past history of not good experiences, and hesitations about enrolling her. Much to my surprise, they were so open and willing to hear all of Mia's needs and see how they could meet them.

From September - December of 2020 we went through a series of academic assessments, trial assignments, and zoom sessions, we finally come to an IEP (individualized education plan) that met all of Mia's needs. She finished out 4th grade at Perry Worth Elementary with a lot of success. Her reading has vastly improved, and she was able to keep up with a 4th grade level of Math, Science, History, and Art. At the beginning of the year we were at a 3rd grade level.

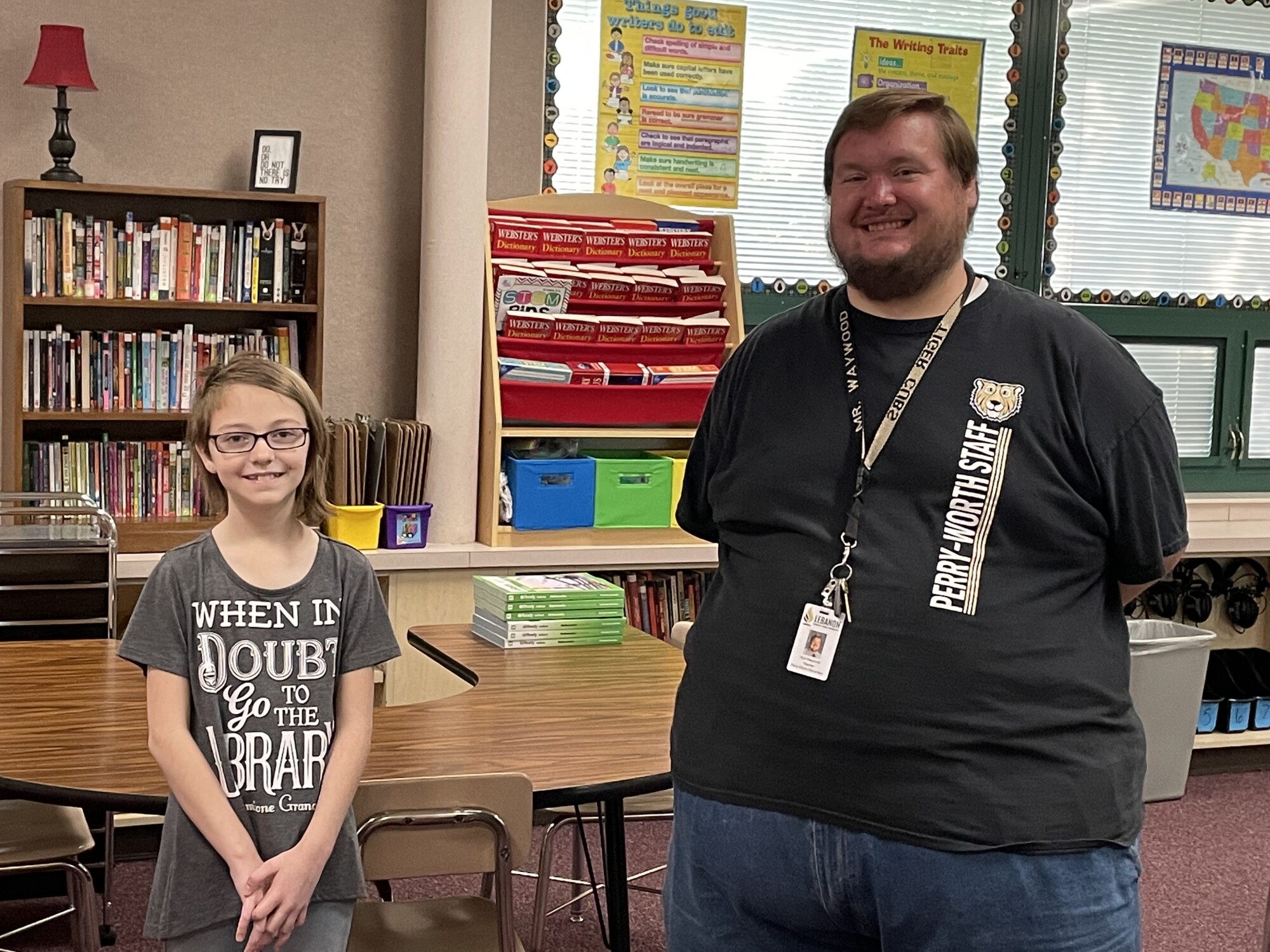

After her first summer break ever, it was time to enroll for the 2021-2022 school year as a 5th grader. My stress level as a mom wasn't as high this year when it was time to enroll. She would still have the same support from her special needs teacher, speech therapist, and special needs classroom helpers. The only new person to join her team this year would be her 5th grade teacher.

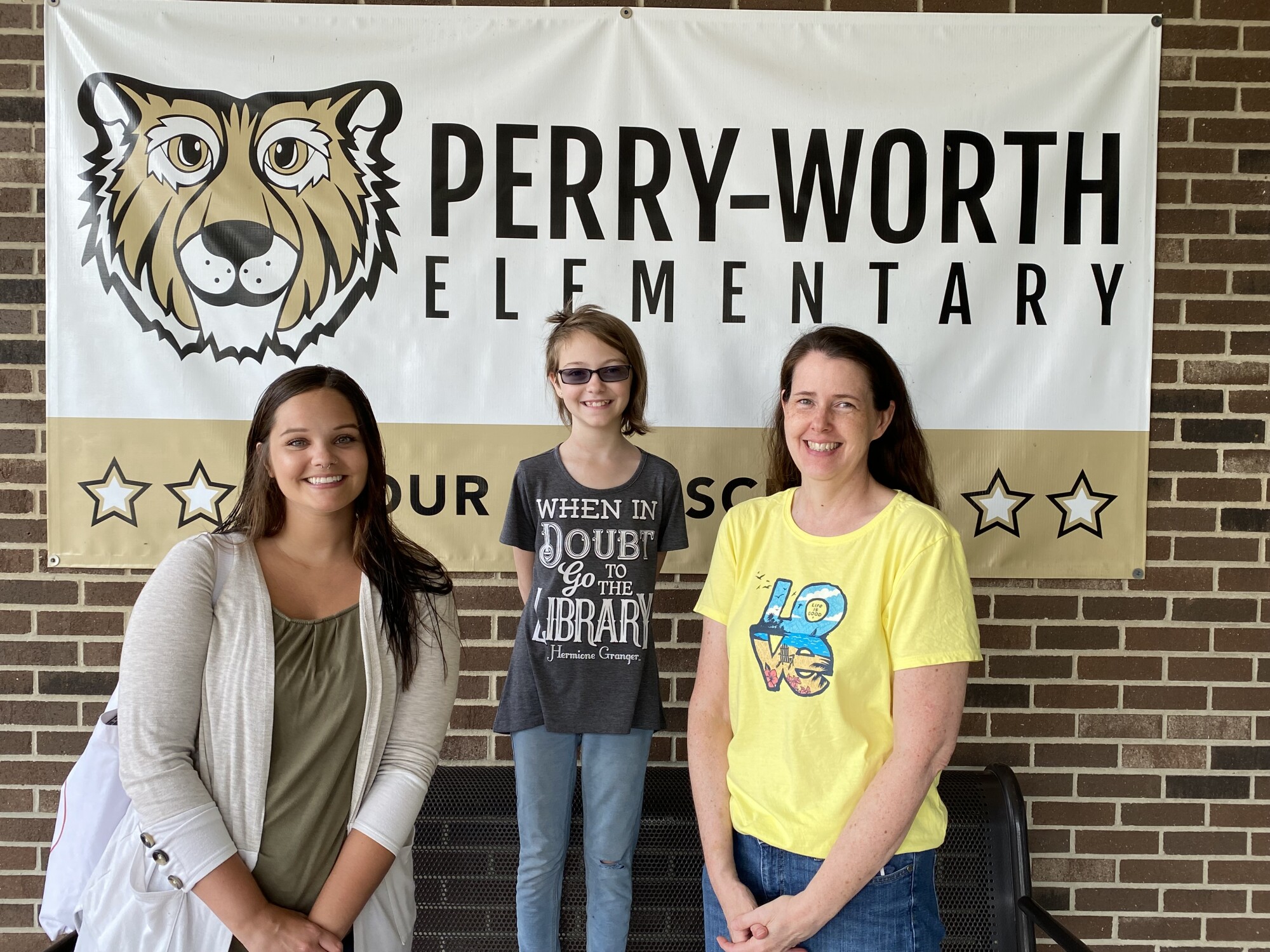

Before all the kiddos went back to school we were able to plan a special trip for Mia to actually visit the school for the first time and meet her teachers, principal, and support staff in person for the very first time. We took a tour, was able to pick up her books for the year, and spend some time with her teacher for this year before school begins.

Mia is super excited for this year instead of being nervous. Her teacher loves video games, Star Wars, Harry Potter, and all the things that are super interesting or favorites of Mia.

I am excited to see her progress this year and so glad we have found somewhere that she is thriving.

I do not regret our homeschooling days, and I am open to going back to homeschooling if transitions to middle school or high school prove to be not supportive or difficult, but for this season, it's where she is thriving!

If you have been following us for a while, you know we don't eat out at restaurants due to all of our food allergies. Craig and I both enjoy watching cooking shows and then creating recipes in a way that we can eat them. Tonight was steak night in our house inspired by Hell's Kitchen.

Ingredients

1 - Filet Mignon

1 - Rib Eye

4 - Organic Russet Potatoes

1 - Yellow Onion

2 - Green Squash

1 - Package Organic Tomatoes

1 - Bunch of Organic Asparagus

1 Tablespoon -Grapeseed Oil

4 - Cloves of Garlic

Salt to taste

Pepper to taste

Lemon Essential Oil

Black Pepper Essential Oil

Primal Kitchen Steak Sauce

Kerrygold Butter

Organic Dijon Mustard

Steaks

My filet was super thick, so Craig actually diced mine up before pan searing it on the stove. We added a drizzle of Grapeseed Oil, salt and pepper to the steak. Once finished, I like to add a few drops of Black Pepper Essential Oil.

His Rib Eye was pan seared on the stove with some KerryGold butter.

Veggies

Chop up your veggies and place into a mixing bowl. We used asparagus, squash, onion, and tomatoes. You can add any other veggies you like. We normally will add mushrooms too, but we were out this time. You will also mince up your garlic cloves. We are huge garlic lovers so feel free to decrease this amount if you desire.

Once all your veggies are chopped, add the minced garlic, drizzle with Grapeseed Oil and season with salt and pepper. Toss your veggies together or mix with your hands so they are mixed up and have an even coating of oil and seasonings.

I then transfer to a cookie sheet and bake in the oven along with the potatoes, but the veggies only need about 10-15 minutes depending on the size of your knife cuts.

Baked Potatoes

Wash your potatoes. We like putting ours into a metal mixing bowl, adding water and about 10 drops of Lemon Essential Oil and letting soak for about 10 mins. The lemon oil will clean the potatoes. After that 10 mins, you can rinse.

Once washed and rinsed. Wrap your potatoes in aluminum foil and bake at 450 degrees for 45-60 minutes depending on the size of your potato.

I topped my baked potato with Dayia Dairy Free Shredded Cheese.

Craig topped his with Kerrygold Butter.

Dijon Butter

I melted about 1 teaspoon of Kerrygold Butter for about 15 seconds and then added Dijon Mustard and stirred together with a fork until creamy.

About the Ingredients

Let's take an inside look at some of our ingredients and why they were chosen.

Organic Vegetables

We choose to always buy organic ingredients and grass fed beef. Organic foods often have more beneficial nutrients, such as antioxidants, than their conventionally-grown counterparts and people with allergies to foods, chemicals, or preservatives may find their symptoms lessen or go away when they eat only organic foods. Organic produce contains fewer pesticides.

Grass Fed Beef

In addition to being packed with B vitamins, grass fed beef has been found to be higher in vitamins A, E, and other antioxidants compared to grain fed beef. Grass-fed beef has significantly lower levels of saturated fat compared to grain-fed beef. In fact, the fat content of grass-fed beef can be compared to skinless chicken. Replacing saturated fat in grain-fed beef with the unsaturated fat in grass-fed beef has been proven to reduce your risk of heart diseases. Studies have also found that grass-fed beef contains more antioxidants than grain-fed beef. Antioxidants help prevent cell damage that can lead to serious diseases such as cancer and Alzheimer's disease. Some people with gluten intolerance or celiac disease will also have symptoms with grain fed beef, I am one of those people.

KerryGold Butter

KerryGold butter comes from Grass Fed cows and is a great all purpose butter (if you eat dairy).

Dayia Cheese

This is a great alternative cheese company for those of us who are gluten and dairy free. If you have tried it in the past and wasn't a huge fan, they recently updated all their recipes and it is now really good!

Primal Kitchen Steak Sauce

I love this steak sauce because it's organic, gluten free, dairy free, sugar free, vegan and no soy!

I just finished watching The Foster's on Hulu. The show was originally on Freeform. I remember when it first was released back in 2013, but during that time our life was in full swing trying to help Mia live her day to day life with all the challenges that brought.

I fell in love with this show! The actors do a fantastic job portraying their character. The series addresses many significant topics such as racial/economic/social inequality, the importance of letting all voices be heard, the damage and issues within the foster care system, the significance in family and friend relationships and the impact they can have in other lives, and so much more.

This show will take your emotions on a journey, but I also think it's a great show to give other perspective on things they may say or do that could hurt others in unintentional ways. I love it when a show can be eye opening. There was something in each episode with the storyline that keeps you wrapped in. I never got bored or was ready for it just be over to see what was going to happen next.

It was really hard for me to pick a favorite character for this show, but I have to choose Callie. She is a beautiful young lady and loves others so deeply. Her heart for wanting to help others is her best quality!

Now, I will be watching the spinoff show, Good Trouble!

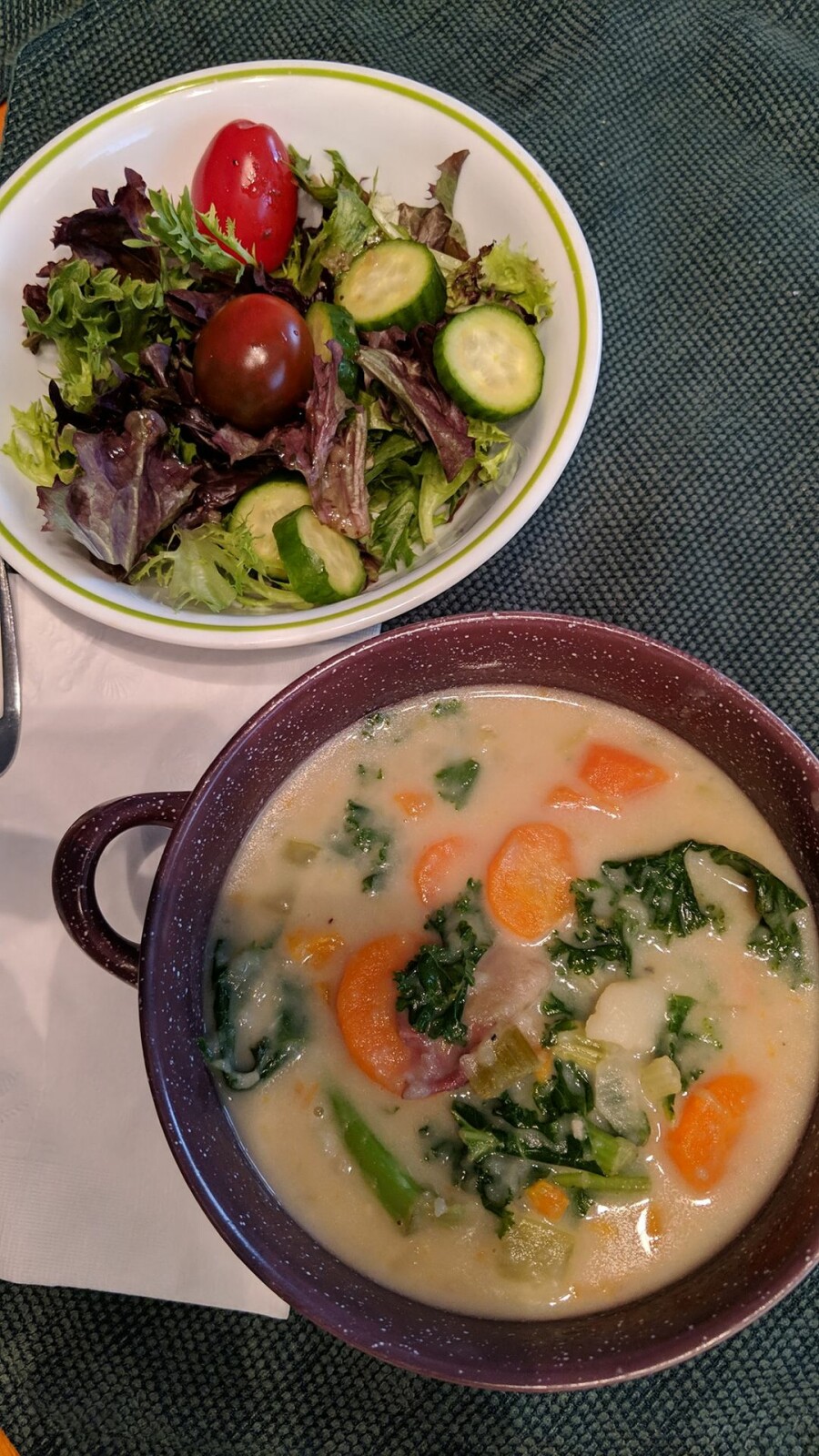

Potato Soup is one of those comfort foods that our family loves. Here is how we still enjoy this family favorite but keep it gluten and dairy free!

3-4 lbs Red Potatoes, diced

1 bunch celery, diced

6 large  carrots, diced

carrots, diced

1 large onion, diced

4 cloves garlic, minced

4 cups liquid (chicken broth, bone broth, or water)

Salt and Pepper

Toss in Instant Pot

Turn on soup setting for 15 minutes

Then add:

Chopped Kale (optional)

2 cans coconut  milk (only add the thick part from the can, not the clear liquid)

milk (only add the thick part from the can, not the clear liquid)

Place cover back on for 5-7 minutes

Once completed, add 3-4 drops of Basil  Vitality Essential Oil

Vitality Essential Oil

One of my favorite snacks is fresh salsa! Here is a quick 5 minute recipe!

2-4 Tomatoes

1 Large Onion

1 Jalapeño Pepper

1 Bunch Fresh Cilantro

6-8 Cloves of Garlic

1 TBSP Salt

1 TBSP Pepper

Juice of 2 Lemons

6 drops of Young Living Lime Vitality Essential Oil

You can combine all ingredients in a food processor for a less chunky version, or chop your tomatoes and onions. I used a vegetable chopper for this batch.