Hi, I'm Terra

Being a mom was a dream I always knew I wanted, but I never expected that being a special needs mom would bring out the person I was truly meant to be. Mia will always be the greatest blessing I have ever received. Each day she teaches me something new and we are all still discovering things about ourselves along the way. From being a complicated pregnancy, premature birth and NICU baby to being diagnosed with Autism by the age of 2, Common Variable Immune Deficiency in 2014, Acid Reflux, Asthma, and around 40 other diagnoses, you could say we have learned our fair share over the years.

Meet Mia

She is brave, confident, wears her heart on her sleeve, patient and loves everyone. Mia loves to sing, dance, draw, and is an avid movie lover. She doesn't realize the impact she has had on the world already by inspiring others with her story and the things she continues to accomplish.

Craig and I met and married in 2006. Our love has grown even stronger through life's challenges and special needs parenting.

We are avid Harry Potter fans, love to travel, and are passionate about achieving our goals. One of those goals was recently brought to life when we built our dream home in 2020. After years of financially struggling with the cost of Mia's health needs, we are currently on the path to being debt free by 2027 if not before by using velocity banking.

Craig spent 20 years as a volunteer fireman, is skilled in emergency preparedness, and loves the gun range. He currently works as a Training Director and runs his own CPR business.

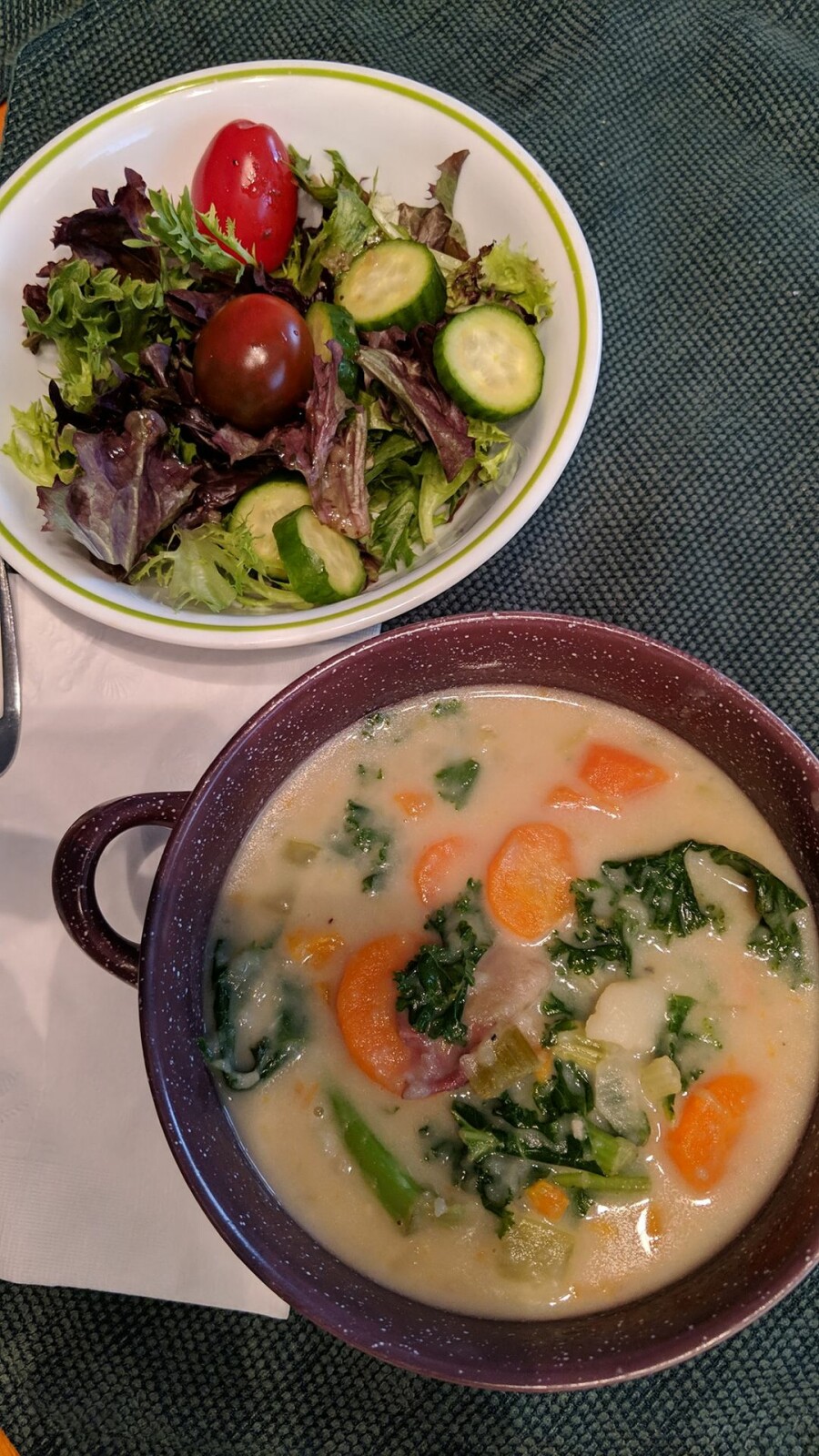

As for me, I love cooking healthy gluten free meals, home decor, shopping, traveling, and bringing ideas to life. After spending years recovering Mia, I am now pursuing dreams that my YL Biz has made possible. I love the opportunity that is provided by not only the products but the opportunity to coach others and help them pursue their dreams.

When I discovered Young Living in 2014, I was as big of a skeptic as anyone, but quickly saw there was something magical in those bottles, which led to reading, learning, and implementing changes that we hadn't already made on our journey to natural health. Mia's typical day at the time was filled with screams up to 12 hours a day, and the first day of using Joy, there was peace in our home the entire day with the exception of about 10 minutes. A believer I became, and was convinced that this new path would have a huge impact in Mia's recovery. Little did I know how much every person in our home would be changed by the products. Over the years, I have not only seen my family's life be forever changed, but I have had the opportunity to help thousands of families fall in love with the oils and a healthier lifestyle. Impacting change by sharing what we learned was God's plan for me all along, I just didn't know it.

I can't wait to learn your story too! xoxo ~ Terra

0 Comments